Budgeting app comparisons trends: what you need to know

Budgeting app comparisons trends indicate a growing reliance on advanced features like AI integration, enhanced security, and user-friendly interfaces, making personal finance management simpler and more effective for users.

Budgeting app comparisons trends are shaping how we manage our finances in a digital age. With so many options available, finding the right tool can feel overwhelming. Let’s explore the features that matter most and which apps stand out.

The rise of budgeting apps

The rise of budgeting apps has transformed the way individuals manage their finances. As more people seek better control over their spending, these apps have quickly gained popularity. They provide an accessible solution for tracking expenses and making smarter financial choices.

Why Budgeting Apps Are Popular

Many users appreciate the convenience these apps bring. With just a few taps, you can monitor your budget and see where your money goes. Furthermore, budgeting apps can help you set goals and achieve financial stability.

- Easy access to financial data

- User-friendly interfaces

- Integration with bank accounts

- Personalized financial suggestions

Moreover, the features of these apps continue to evolve. Innovations in technology make budgeting more straightforward, allowing you to sync your accounts effortlessly. Additionally, many apps offer insights into spending habits, helping you identify unnecessary expenses.

The Impact on Financial Literacy

The greater use of budgeting apps has also increased overall financial literacy. Users learn to understand their financial habits better. As they engage with the app, they often become more aware of their spending patterns, leading to improved decision-making.

This surge in awareness contributes to healthier financial habits. Users are more likely to prioritize savings when they see their expenditures clearly visualized. By embracing these technologies, people are setting themselves up for long-term success.

Key features to look for

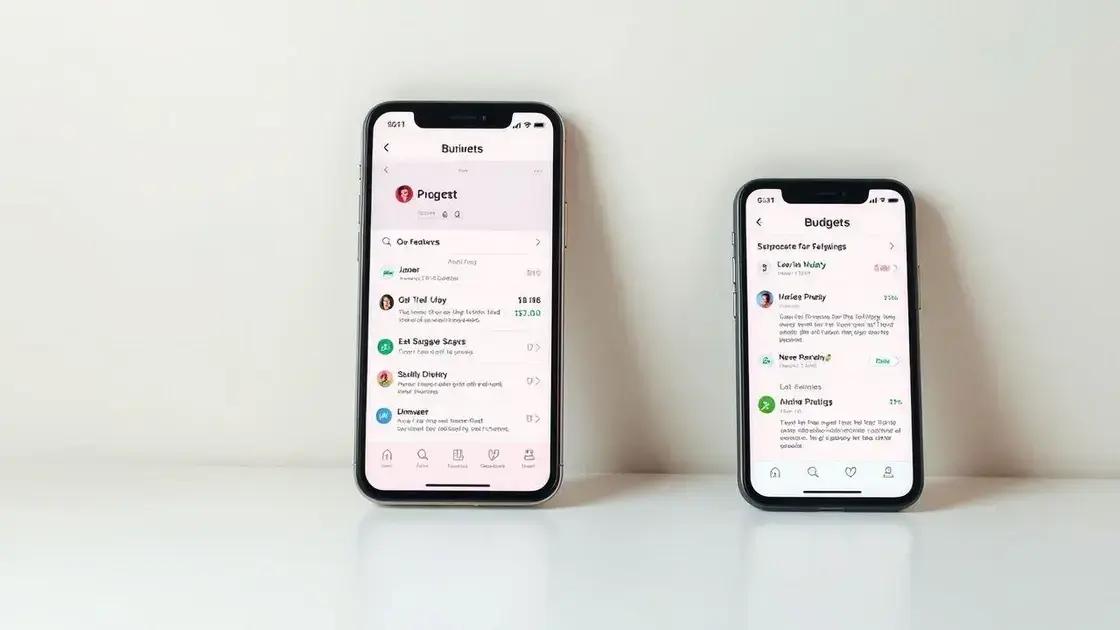

When choosing a budgeting app, identifying the key features is essential to ensure it meets your needs. These features can enhance your financial management experience, making it easier to track expenses and achieve goals.

User-Friendly Interface

A good budgeting app should have a simple and intuitive design. This allows users to navigate the app without difficulty, making it more efficient to manage finances. A well-organized layout helps you find what you need quickly.

- Clear navigation menus

- Simple dashboards with visualizations

- Customizable settings for personal preferences

Another important feature is the ability to connect to your bank accounts. Many budgeting apps offer direct synchronization, which means your spending data updates automatically. This ensures you always have the latest information available.

Expense Tracking and Categorization

Effective expense tracking helps users understand their spending habits. The best budgeting apps allow you to categorize expenses easily. By organizing spending into categories, you can see where your money is going each month.

Many apps also enable you to set budgets for each category. This mechanism encourages responsible spending and helps in reaching your financial goals. Additionally, some apps send notifications when you are close to exceeding your budget.

Finally, reports and analytics are valuable features that shouldn’t be overlooked. These tools provide insights into your financial habits and highlight trends over time. Analyzing your finances regularly can lead to better decision-making.

Comparing top budgeting apps

When comparing top budgeting apps, it’s essential to consider various factors that impact their performance. Each app has unique features that can cater to different financial needs. Understanding these can help you choose the right one for your situation.

User Reviews and Ratings

User feedback provides valuable insights into the app’s effectiveness. High ratings often indicate that the app is user-friendly and meets expectations. Check reviews to identify common praises or complaints made by users.

- Look for apps with a large number of reviews for credibility.

- Note any recurring issues mentioned by multiple users.

- Evaluate positive feedback about key features.

Another critical aspect is the pricing structure. Some apps offer free versions with limited features, while others require a subscription for full access. Compare what you get at each price point to see which app offers the best value for your needs.

Feature Comparisons

It’s also helpful to create a checklist of features that matter to you. For example, consider whether you need expense tracking, bill reminders, or integration with your bank account. Some apps may have advanced features such as financial goal setting and investment tracking, which could be beneficial.

Additionally, consider how easy it is to navigate each app. A straightforward layout often leads to a better user experience. Spending time exploring their interfaces can give you a feel for how accessible their features are. Remember, an app is only as useful as it is easy to use.

User experiences and testimonials

User experiences and testimonials play a crucial role in understanding how budgeting apps work in real life. Hearing from actual users gives potential customers a glimpse into the app’s effectiveness and reliability.

What Users Are Saying

Many users highlight how budgeting apps have simplified tracking their expenses. They often share stories of how these tools helped them make informed financial decisions. For instance, one user mentioned that by monitoring their spending through an app, they realized they were overspending on dining out.

- The app helped users identify favorite spending areas.

- Users appreciate reminders for upcoming bills.

- Many find customized reports useful for planning.

User testimonials also emphasize the importance of features like customer support. Quick responses to queries can make a difference in user satisfaction. A satisfied user often shares their positive interaction with customer support, which builds trust in the app.

Challenges Users Face

However, not all experiences are perfect. Some users report difficulties with syncing bank accounts or slow app performance. Others express the need for more features, indicating that while an app may be good, there’s always room for improvement. Collecting feedback about these challenges can help app developers enhance user experience.

Overall, combining positive experiences and constructive criticism could lead to better and more reliable budgeting apps in the market. As more users share their stories, the community can help guide prospective users towards the best choices.

Future trends in budgeting technology

The future trends in budgeting technology are shaping how people manage their finances. As technology evolves, we can expect budgeting apps to become more advanced and user-friendly.

Integration with AI and Machine Learning

One significant trend is the integration of artificial intelligence (AI) in budgeting apps. AI can analyze your spending habits and provide tailored advice. For example, it might suggest areas where you can cut back or highlight subscription services you no longer use.

- Smart notifications for spending limits.

- Personalized financial insights based on past behavior.

- Predictive budgeting for future expenses.

Machine learning algorithms can enhance these features, making budgeting even more accurate. Users will likely find that the app becomes more efficient the longer they use it.

Enhanced Security Measures

With the rise of digital transactions, security is a top priority. Future budgeting apps will focus on advanced security measures to protect user data. Features like biometric authentication and encrypted data storage will become standard.

Another trend is the use of blockchain technology. This can provide users with greater transparency and security when managing their finances. Blockchain could allow for secure sharing of financial data without compromising privacy.

Finally, the integration of virtual and augmented reality (VR/AR) into budgeting apps may become a reality. Users could visualize their financial data in immersive environments, making analysis engaging and intuitive.

FAQ – Frequently Asked Questions about Budgeting Apps

What are budgeting apps used for?

Budgeting apps help users track and manage their finances, monitor spending habits, and set financial goals.

How can AI enhance budgeting apps?

AI can analyze spending patterns and provide personalized recommendations, making budgeting easier and more effective.

What security features should I look for in a budgeting app?

Look for features like biometric authentication, encryption, and secure data storage to protect your financial information.

Are there free budgeting apps available?

Yes, many budgeting apps offer free versions with essential features, while others provide premium services for a fee.